How We Helped WSECU

Drive A 44% Increase In

Mobile Member Engagement

Since its establishment in 1957, Washington State Employees Credit Union (WSECU) is known for the exceptional service they deliver to more than 280,000 credit union members. With over $5 billion in assets, 24 branches, and over 800 employees, WSECU has cemented itself as one of the largest credit unions in Washington State. True to their brand identity, WSECU champions for financial wellbeing and weaves equitable access to services throughout their business strategy.

A major part of this success is WSECU’s commitment to evolving their member experience. In 2020, WSECU recommitted to improving the financial lives of their members after consumer expectations changed dramatically post-pandemic. To continue providing their distinguished member experience, the credit union knew they had to adapt to changing times.

From strategy design to platform development, WSECU engaged Aequilibrium to redesign their mobile banking strategy.

Financial

Healthcare

Technology

Accessibility Testing

Brand Design

Information Architecture

Digital Design

WordPress Development

Content Management

Brand Messaging

Website Design

Copywriting

UX/UI Design

Full Stack Development

to Competitors

A few years prior to this digital transformation, WSECU’s online banking platform struggled to meet member needs. At the time, they had two separate providers for web and mobile, both with a limited ability to customize. Workflows between online and mobile banking differed, as did key capabilities. Their fragmented digital experience and outdated UI were not only failing to engage members, but driving them away entirely.

Digital member engagement was consistently declining by 10% year over year, with nearly 47% of customers switching to another financial institution altogether. This story is not lost on credit unions today, as 33% of members tend to switch if the digital experience doesn’t fit their needs.

With other credit unions adopting digital as their main method of engagement, WSECU knew they had to pivot to earn the trust of their members once again.

Enter AEQ.

![]() Aequilibrium is a great partner to us and fully embodies the concept of one team, working side by side with us to support our digital transformation.

Aequilibrium is a great partner to us and fully embodies the concept of one team, working side by side with us to support our digital transformation.![]()

David Luchtel, former VP of Information Technology, WSECU

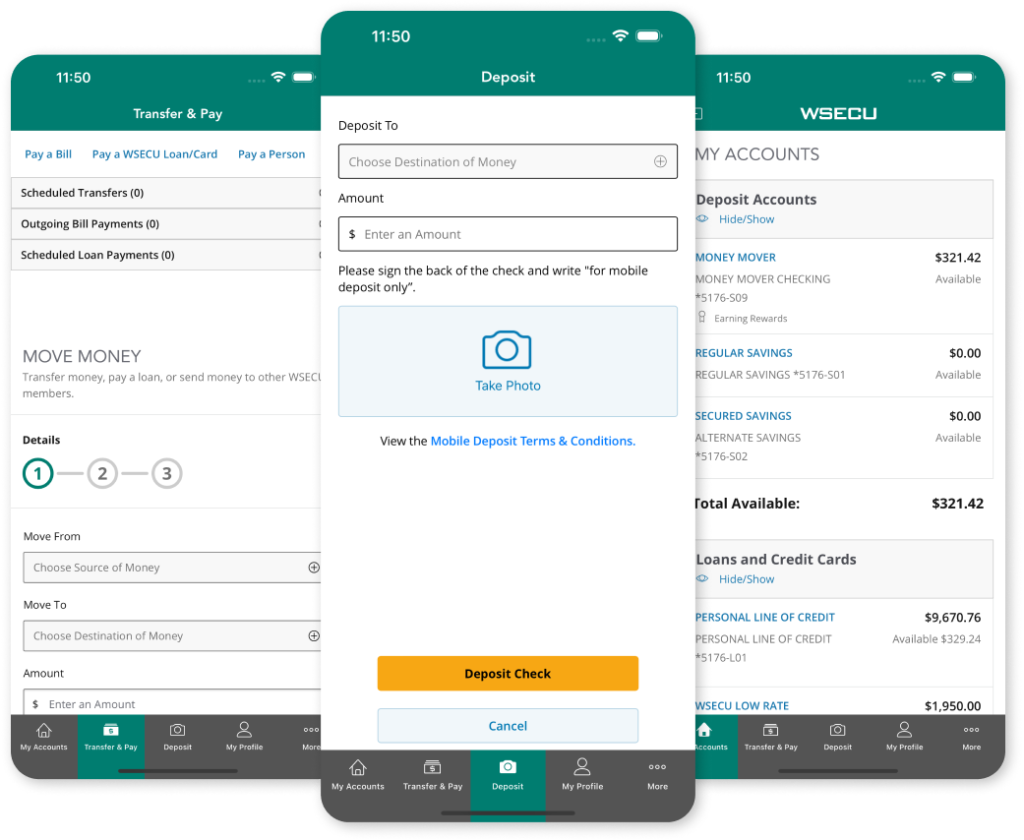

Digital Banking Application

Since the MVP app launched in 2019, WSECU has seen significant improvements across member retention. Within the app, digital transactions grew by 11%. In addition, the credit union saw a 44% growth increase in mobile usage for banking services after the upgrades were implemented. In addition, since the launch of the app, WSECU saw member growth increase by 20,000 members over a two year period.

Now, AEQ’s development team uses their expertise in iOS, Android, and Backend development to maintain the app to the highest standards set by both WSECU and its members. With an average app store rating of 4 stars between the App Store and Google Play, WSECU’s NextGen App represents the best of the digital transformation.

Blending the digital and human experience is our motto at AEQ. If your credit union needs a mobile app that actually engages, reach out to us here, or check out our work with Central 1 and DUCA.

11%

transactions

44%

20,000

over two years

Engagement App

Designed to establish long-term relationships with members, the NextGen App delivers a comprehensive marketable product with enhanced usability, feature parity, and custom integrations. With an estimated release date between Feb/March in 2024, WSECU members are looking to see how the NextGen Member App can eleveate their digital banking experience.

Get in touch

Let’s chat about your brand’s digital needs