The sunsetting of Central 1’s Forge digital banking platform has left roughly 183 credit unions searching for viable alternatives. These institutions must adopt a platform that ensures continuity of service, meets evolving customer expectations, and supports digital transformation.

This report evaluates three leading digital banking platforms: ebankIT, VeriPark, and Intellect Design. The analysis aims to help credit unions identify the platform that best aligns with their operational needs and long-term goals.

Methodology

To ensure a comprehensive and agnostic analysis, this report employs a structured research approach:

Primary Research:

- Reviewed technical documentation and product demos to understand platform architecture and functionality.

- Analyzed case studies and whitepapers to identify real-world applications.

Secondary Research:

- Examined industry evaluations, such as Gartner Peer Insights and Aite’s Payments Hub Matrix.

- Collected user reviews to understand deployment experiences and satisfaction levels.

Technical Analysis:

- Compared architectural designs (e.g., modularity, API-first approach, microservices).

- Evaluated integration capabilities, scalability, technology stack and adaptability.

Industry Recognition:

- Considered awards and inclusion in leading market guides to validate platform relevance.

Comparative Analysis

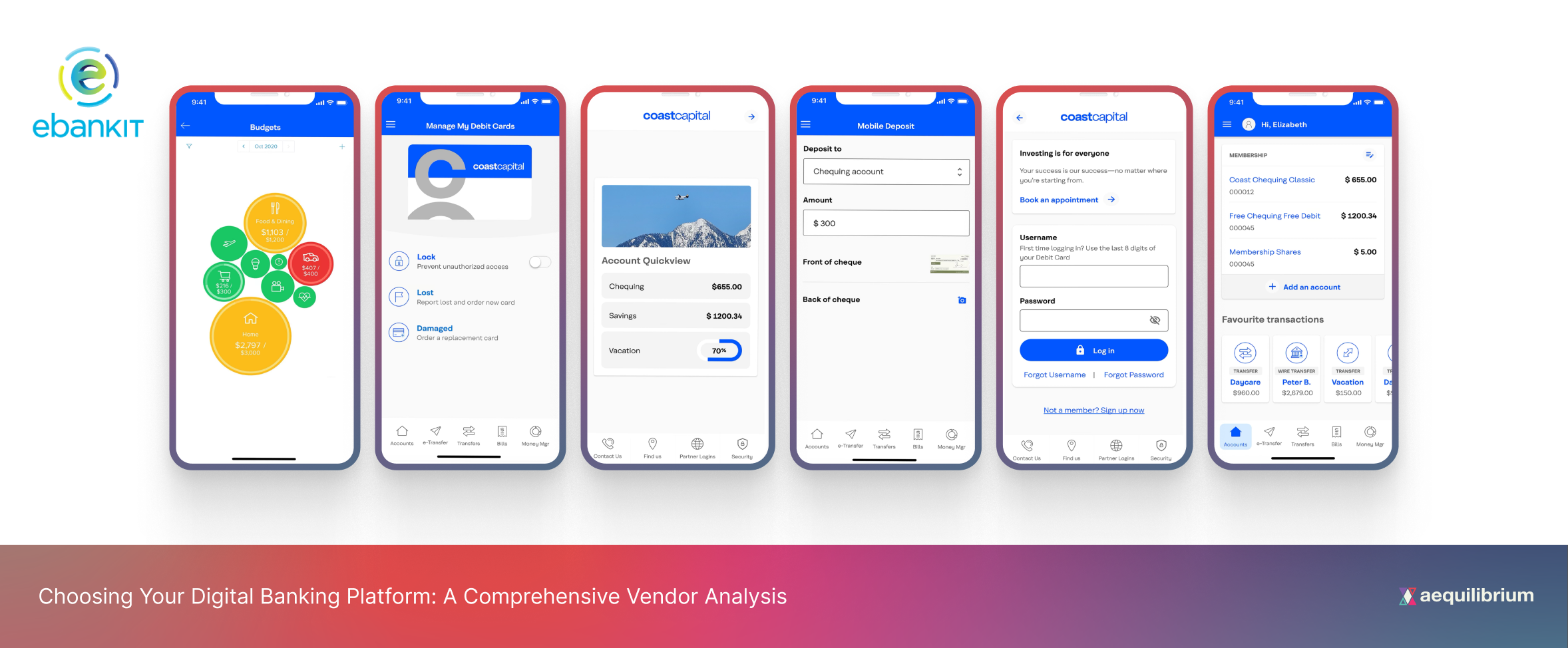

1. ebankIT

Company Profile:

- Founded: 2014, headquartered in Portugal.

- Overview: Focused on providing cutting-edge omnichannel banking solutions for small to medium-sized financial institutions.

- Clients: Known for serving credit unions and regional banks across North America and Europe. Flagship implementations in Canada include Coast Capital, Alterna, Conexus, and Servus CU.

- People: With about 200 staff based mostly in Portugal, eBankIT doesn’t have tech delivery resources in Canada except through partners like Aequilibrium.

Architectural Framework:

- Modular and omnichannel platform designed for rapid deployment and scalability.

- Supports seamless integration across mobile, web, and wearables.

Tech Stack:

- Backend: Built predominantly on .NET Framework.

- Cloud: Compatible with Microsoft Azure for hosting and services.

- Integration: API-first architecture using RESTful services.

- Frontend: Uses modern frameworks such as ReactJS and Angular.

- Database: Supports SQL Server for data management.

Integration Capabilities:

- Easy integration with legacy systems and third-party applications.

- Extensive API catalog for extending functionality.

Scalability:

- Modular design supports scaling based on evolving customer and institutional needs.

- Modular design supports scaling based on evolving customer and institutional needs.

Functionalities:

- Digital Onboarding: Efficient processes for customer acquisition.

- Marketing Tools: Personalization features for targeted campaigns.

- Back Office Management: Streamlines internal operations.

Recognition:

- Rated 4.6/5 on Gartner Peer Insights.

- Included in Gartner’s 2024 Market Guide for Digital Banking Platforms.

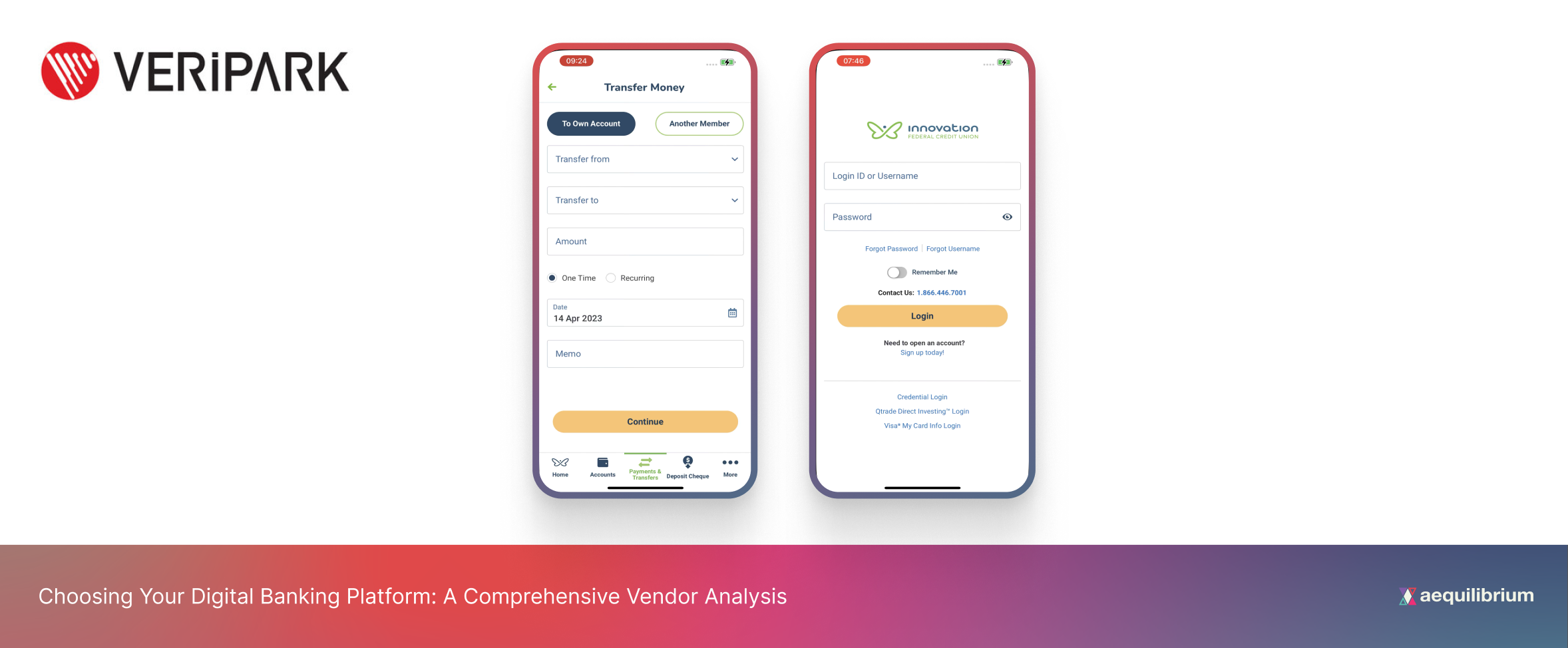

2. VeriPark (VP)

Company Profile:

- Founded: 1998, headquartered in Istanbul, Turkiye.

- Overview: Specializes in omnichannel delivery and CRM integration for financial institutions.

- Clients: Works with large banks and credit unions across North America, Europe, and the Middle East. In Canada, Innovation CU uses VP. Beem CU announced they chose VP in May 2024, while the VP coalition (First West Credit Union, Prospera Credit Union, DUCA Credit Union, and Coastal Community Credit Union) was announced in January 2025.

- People: With about 1,000 staff based mostly in Turkiye, Pakistan, and India, VP has about 10 tech delivery resources in Canada, unless augmented by partners like Aequilibrium.

Architectural Framework:

- Built around the VeriChannel platform, focusing on CRM and customer journey management.

- Unified experience across all digital channels.

Tech Stack:

- Backend: Developed primarily on Microsoft .NET Core.

- Cloud: Optimized for Microsoft Azure; integrates seamlessly with Azure services.

- CRM: Deep integration with Microsoft Dynamics 365.

- Frontend: Leverages AngularJS and ReactJS.

- Database: Uses SQL Server and supports integration with Azure SQL.

Integration Capabilities:

- Strong integration capabilities with existing systems.

- Seamless CRM integration and analytics capabilities through Dynamics 365.

Scalability:

- Handles high transaction volumes, catering to large institutions.

- Handles high transaction volumes, catering to large institutions.

Functionalities:

- CRM Integration: Enhances customer relationship management.

- Omnichannel Support: Delivers consistent experiences across platforms.

- Analytics: Enables data-driven personalization.

Recognition:

- Recognized in Gartner’s 2024 Market Guide for Digital Banking Platforms.

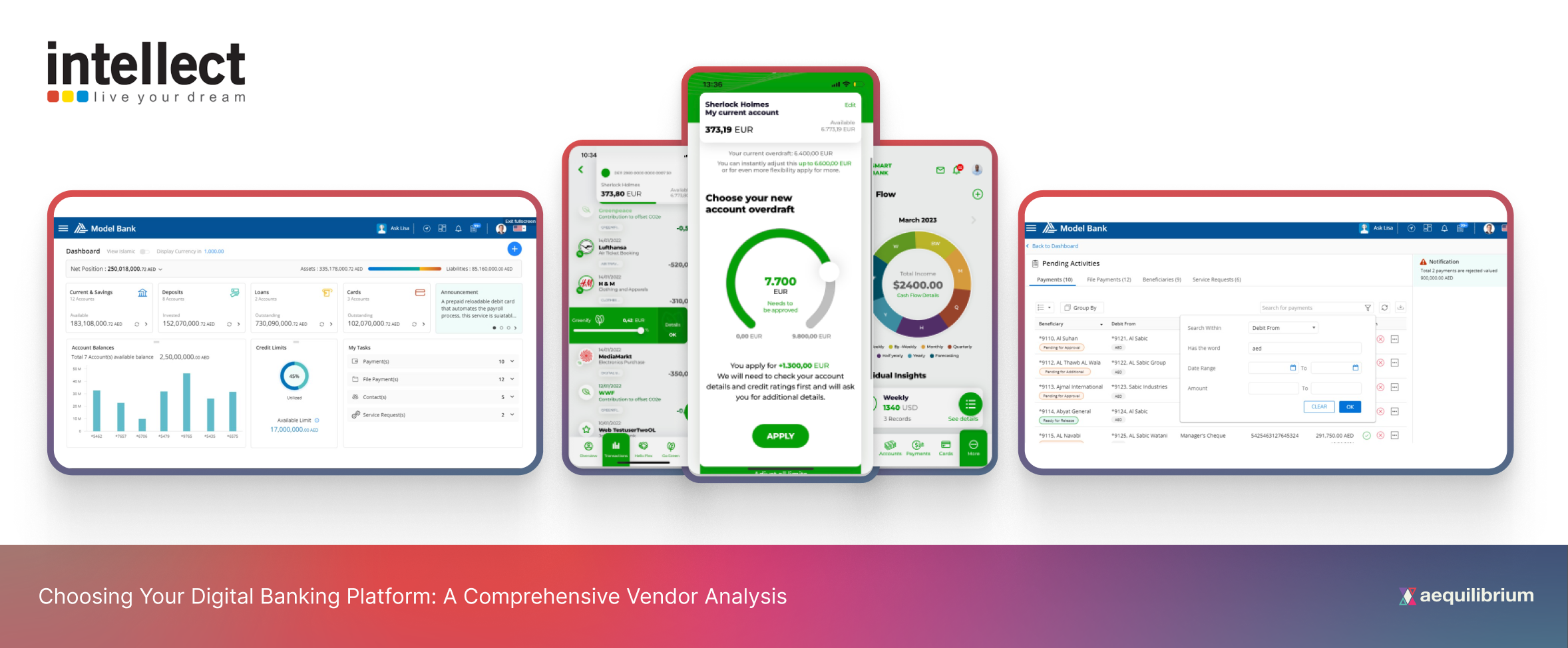

Intellect Design (ID)

Company Profile:

- Founded: 2011, headquartered in Chennai, India.

- Overview: Focuses on providing digital banking transformation solutions using AI and microservices-based architecture.

- Clients: Serves large banks and financial institutions worldwide. Vancity chose to partner with ID in June 2024.

- People: at about 8,000 staff, based mostly in India, ID has about 50 tech delivery resources in Canada. They will have their hands full with Central 1’s digital banking operations.

Architectural Framework:

- Cloud-native, API-first, and microservices-based.

- Modular and flexible design for large-scale operations.

Tech Stack:

- Backend: Developed using Java with microservices architecture.

- Cloud: Supports deployment on AWS, Microsoft Azure, and Google Cloud.

- AI/ML: Uses Python for AI and machine learning models.

- Frontend: Employs modern JavaScript frameworks such as ReactJS.

- Integration: API-led integration with RESTful and GraphQL services.

- Database: Compatible with PostgreSQL, MySQL, and MongoDB.

Integration Capabilities:

- API-first approach ensures seamless integration with legacy and third-party systems.

- Supports an extensive ecosystem for innovation.

Scalability:

- Designed for extensive operations in retail and corporate banking.

- Designed for extensive operations in retail and corporate banking.

Functionalities:

- Digital Core Banking: Comprehensive solutions for core banking needs.

- AI-Driven Insights: Advanced analytics for hyper-personalized services.

- Modular Solutions: Tailored features for specific banking needs.

Recognition:

- Rated 4.2/5 on Gartner Peer Insights.

- Recognized in Aite’s Payments Hub Matrix for payment platform excellence.

Comparative Summary: At A Glance

- ebankIT: Ideal for mid-sized institutions seeking rapid deployment and omnichannel consistency.

- VeriPark: A strong choice for organizations prioritizing CRM and customer journey management.

- Intellect Design: Best suited for large-scale operations focusing on AI, scalability, and modularity.

Canadian credit unions exiting Forge should assess their size, strategic goals, and technical requirements to select the platform that aligns with their operational vision.

Baris Tuncertan

Head of Technology

[email protected]

Reach out to Baris directly or contact our team for more information