While customer expectations in today’s digital world are continuously changing, banking chatbots with smart, intuitive conversational UI are leading the way in improving customer experiences for financial institutions. Chatbots are an easy solution to many legacy banking problems, giving an incredible leg up to progressive banks and credit unions.

A chatbot is a computer program or an artificial intelligence which conducts a conversation via auditory or textual methods.

Chatbots are typically used in dialog systems for various practical purposes including customer service or information acquisition. Some chatbots use sophisticated natural language processing systems, but many simpler systems scan for keywords within the input, then pull a reply with the most matching keywords, or the most similar wording pattern, from a database.

Many of the big banks have already incorporated banking chatbots into their system. For example, Bank of Montreal recently launched AI-powered chatbots on Facebook and Twitter while Bank of America introduced “Erica”. There are multiple reasons why a financial institution should integrate a chatbot into their customer strategy. Here are a few reasons why:

Customer expectations have changed

We now live in a digital world where customers are aware of how fast and efficient products and services can be. They have developed an expectation that everything from food delivery to banking should be accessible anywhere, anytime. Banks specifically can now reach customers more easily and frequently and have given customers unprecedented access to their financial information. With the advent of online and mobile banking in today’s digital world, why not build a chatbot to meet your customer needs?

Offer fast, around-the-clock customer support

It’s not a secret that customer satisfaction is the key to growth. When it comes to personal finance, it is especially necessary for customers to know that support is offered 24/7. Chatbots can help with tasks like resolving queries, options to update, and provide information on new products and services around the clock. In addition to these automated services, chatbots can guarantee that customers are attended to in the shortest period of time.

Reduce time with automated answers

How many times a day do you get asked, “What are your banking hours?” or “What are your banking fees?”. Chatbots have the ability to automate all of the repetitive questions, as well as check real-time account balances or see statements of transactions using a simple interface.

Physical call centers and branches focused on handling customer support is one of the costliest operations. This easy-build service can save your front-line hours of time through automating customer support, allowing you to provide more personalized services and humanized advice to your valued customers.

Provide more robust data resources

Financial advice is where customers will need in-person support the most. Banking chatbots are therefore useful when needing to alleviate the time spent on sharing customer data reports. Most of these resources, including graphs showing spending over time or savings rates, are digitally aggregated using algorithms. Therefore, sharing this information with customers can become more efficient with the introduction of a bot that has been trained to organize and send such data with the simple press of a button.

Increase security measures

Banking chatbots can be programmed to require multiple logins, password checks, and identity authentication. It can also be programmed to lock accounts if it detects too many incorrect login attempts. Banking chatbots, therefore, have the potential to increase security measures through stronger authentication protocol and more advanced information protection.

Engage in personalized conversations

Of course, we cannot undervalue the importance of personalization when it comes to interacting with customers. There is sometimes a negative connotation with digital devices and automated technology, that it typically lacks a human element. However, chatbots have been accoladed for its user-centric two-way conversational design. Conversation is a natural human medium and chatbots can be programmed to speak in a familiar language and tones that mimic the way we interact as humans in real life.

Some may disagree, presenting a case that robots should not sound and/or feel like people. In this case, product designers may be tasked to craft a UI that is evidently artificial. Either way, the capabilities for banking chatbots to personalize services are there.

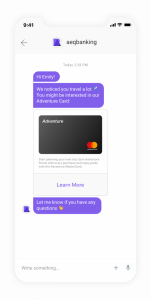

Deliver personalized marketing

Digitizing this phase of your banking system can be supported by a set of personalized marketing. Banks have a wide range of products and services for their customers, but it is unrealistic to assume that customers will know what is available and which is most applicable to their particular situation. Personalized marketing allows machines to search and optimize customer data and increase conversion rates for banks by delivering recommendations that are meaningful and accurate.

Meet customers where they’re at

Lastly, go to your customers rather than wait for them to come to you. Business Insider’s 2016 report found that Facebook Messenger alone boasts one billion monthly active users, and the top three messaging platforms attract over three billion users daily. With messaging platforms like Facebook Messenger and WhatsApp becoming increasingly popular, consumers are spending the majority of their mobile screen time on these platforms. Building a chatbot for a platform where customers already are can help infinitely grow your banking business potential.

In Summary

Why should financial institutions use banking chatbots?

- Customer expectations have changed and they are waiting for banks to come to them

- You can offer fast and efficient 24/7 service

- Reduce time, costs, and overall resources with automated banking services

- Provide more robust data resources

- Increase security measures

- Offer the most personalized mode of communication while balancing digital efficiency

- Compliment services with tailored, optimized marketing

- Don’t get left behind while statistics show messaging apps are now