Breaking Down the Old Framework: Moving Beyond Forge

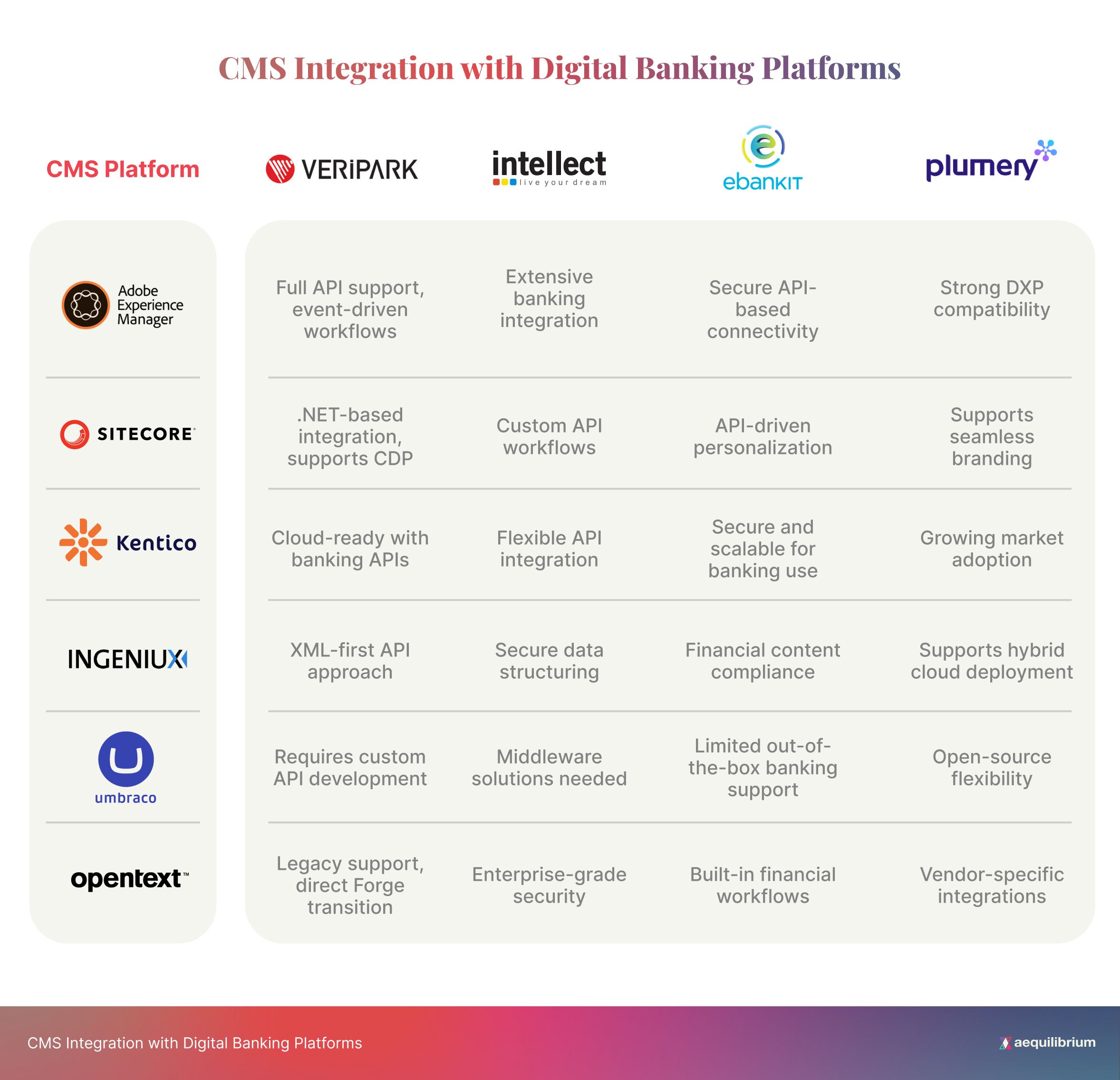

As Canadian credit unions migrate from Central 1’s Forge platform, selecting the right Content Management System (CMS) becomes a crucial decision. Forge integrated OpenText CMS for public websites, but with its discontinuation, credit unions must now choose a CMS that aligns with their new digital banking platform. This article provides a technical breakdown of CMS integration, security, data migration, and scalability considerations with VeriPark, Intellect Design, eBankIT, and Plumery.

Selecting the Right Blueprint: Choosing Your CMS

Before selecting a CMS, credit unions should evaluate:

- Integration Capabilities: The ability of the CMS to seamlessly connect with digital banking platforms via APIs, middleware, or direct connectors. Evaluate whether the CMS supports RESTful APIs, SOAP, GraphQL, or other integration frameworks that enable smooth data flow between the public website and the banking core. Also, consider event-driven architectures for real-time synchronization and workflow automation.

- Security & Compliance: Security is paramount for financial institutions. The CMS must support industry-standard authentication mechanisms such as OAuth 2.0, SAML, or OpenID Connect for secure identity verification. Compliance with regulations such as PCI DSS for payment security, GDPR/PIPEDA for data privacy, and TLS 1.2/1.3 for encrypted communication is essential. Look for role-based access control (RBAC), multi-factor authentication (MFA), and automated security updates.

- Scalability & Performance: A CMS should support both current and future growth requirements. Consider whether the CMS can be deployed on a cloud-native architecture that scales dynamically with traffic fluctuations. Look for built-in caching mechanisms, load balancing support, and CDN integration to ensure low latency. Evaluate database performance optimization techniques, such as query indexing and replication, to prevent performance bottlenecks.

- Data Migration & Mapping: Transitioning from OpenText or other legacy systems requires an effective data migration strategy. Define an ETL (Extract, Transform, Load) process that maps legacy content structures to the new CMS. Ensure that metadata, images, documents, and structured financial data retain their integrity during migration. Validate migration scripts through dry-run testing and reconciliation processes to minimize data loss or corruption.

- Customization & Extendibility: The CMS should provide flexibility for tailoring features to credit union needs. Evaluate whether the CMS supports plugin architectures, custom module development, and headless CMS capabilities to integrate with different digital banking interfaces. Consider frameworks like React, Angular, or Vue.js for a modern front-end experience. AI-driven personalization engines can enhance member engagement by dynamically recommending content based on user behavior.

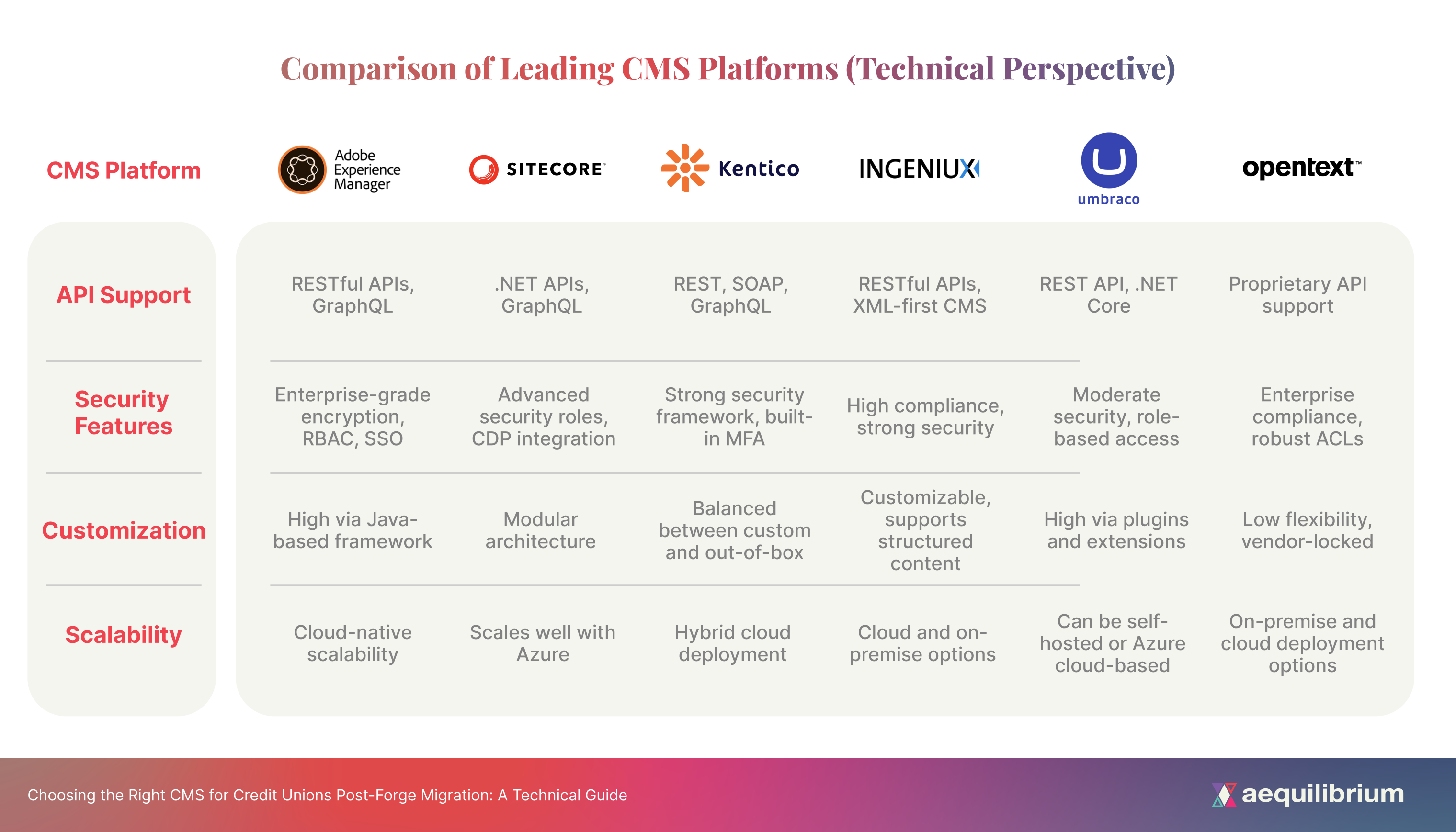

Comparison of Leading CMS Platforms (Technical Perspective)

CMS Integration with Digital Banking Platforms

Reinforcing the Foundation: Security & Compliance

- OAuth 2.0 & SAML Authentication: Secure authentication protocols that ensure only authorized users can access sensitive data and services. These standards help integrate Single Sign-On (SSO) and federated identity management.

- Data Encryption Standards: Ensuring secure data handling using TLS 1.2/1.3 for encrypted transmission and AES-256 encryption for data at rest to protect sensitive member information.

- Role-Based Access Control (RBAC): Granular permission settings that restrict access to different levels within the CMS, ensuring compliance with internal security policies.

- GDPR & PIPEDA Compliance: Implementation of data retention policies, consent management, and data access controls to adhere to privacy regulations in Canada and globally.

- PCI DSS & Secure Payment Integration: Essential for credit unions managing transactions, ensuring the CMS supports secure payment gateways and encrypted payment data transmission.

Transferring Components: Data Migration Strategy

- ETL Process Design: Define Extract, Transform, and Load (ETL) workflows to extract legacy data, map it to the new system, and transform formats where needed.

- Data Schema Mapping: Identify discrepancies between Forge’s data structures and the new CMS, ensuring consistency across fields such as member profiles, transactions, and content assets.

- Content Transformation: Automate migration processes to convert HTML, CSS, and embedded media to align with modern web frameworks and CMS templates.

- Testing & Validation: Implement thorough testing strategies, including dry runs, reconciliation checks, and audit trails to verify data integrity post-migration.

Customizing the Build: Extending & Personalizing Your CMS

- Headless CMS Options: Allow seamless content delivery across web, mobile, and other digital touchpoints, enabling a more flexible and scalable architecture.

- Custom Plugin Development: Extend CMS functionality by developing modules that integrate banking tools, chatbots, or AI-driven recommendation engines.

- AI-Driven Personalization: Leverage machine learning to create dynamic, member-specific content experiences, offering targeted products and services based on user behavior analytics.

The Final Inspection: Selecting the Best CMS for the Job

Selecting the right CMS depends on the credit union’s size, technical resources, and future roadmap:- For innovation and deep personalization → Choose Adobe Experience Manager or Sitecore.

- For cost-effective, flexible solutions → Choose Kentico or Umbraco.

- For a balance of security and structured financial content management → Choose Ingeniux.

- For a seamless transition from Forge → OpenText remains the easiest option but comes with high costs.

Baris Tuncertan

Head of Technology

[email protected]

Need help choosing the best CMS for your credit union? Contact our digital transformation team for a consultation.