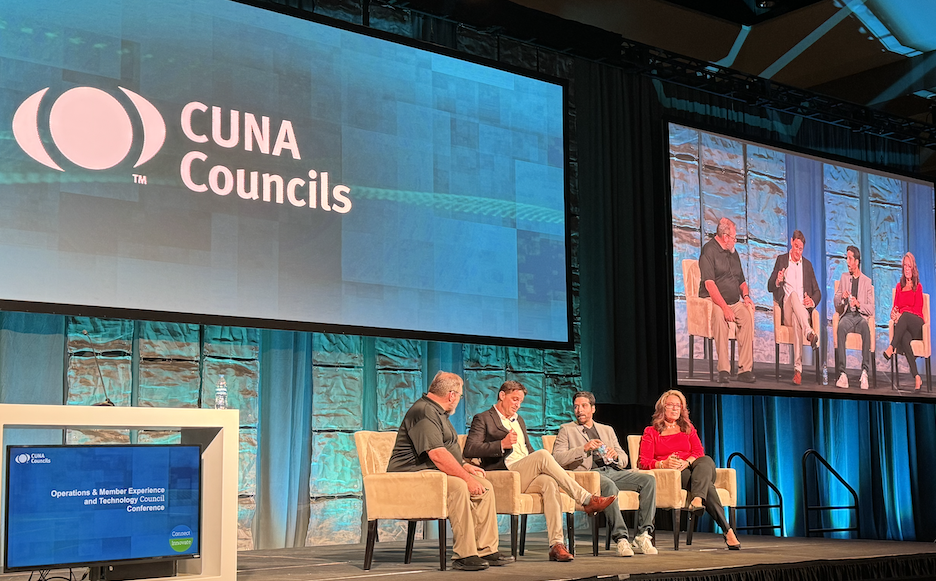

In the last few months, Aequilibrium has sponsored the Credit Union Technology Forum conference in Halifax, and the World Credit Union in Vancouver. Last month we joined CUNA as Associate Business Members, and sponsored the CUNA OME Conference in Denver, part of our continuous commitment to the credit union movement.

Fresh from the enlightening experience at the CUNA OME Conference, the Aequilibrium (AEQ) team is thrilled to share our reflections, learnings, and insights. This year’s conference was a treasure trove of innovative ideas, and here’s our comprehensive breakdown.

Conference Overview

Spanning over four days, the conference was meticulously structured to offer attendees a blend of knowledge-sharing, hands-on experiences, and networking opportunities. The event began with a Roundtable Exchange, an interactive session that fostered open dialogue among credit union professionals.

The Conference was kicked-off by Stephanie Mehta, the former Editor-in-Chief of Fast Company,who emphasized the importance of nurturing an innovative culture in today’s rapidly evolving landscape, “Every company is a fast company. You just have to find the fast parts of a slow company.”

With many sessions ranging from AI applications in credit unions to the significance of a digital roadmap, attendees were presented with a buffet of transformative strategies.

Speed Rounds

I enjoyed this fast-paced session, consisting of two rounds, in which fintech companies pitched their services to CU leaders. It’s no surprise that this has been the highest-rated conference session every year. The speed round consisted of twenty-two fintechs, who pitched to a panel of three judges. With only a 5-minute demo and 2 minutes of Q&A by the judges, it was an awesome experience. It was a great opportunity to see innovative solutions and vote for your favorite presenter.

Deep Dive into Panel Discussions

At A Glance:

This session showcased real-world AI applications within credit unions. The emphasis was on generative AI tools and their potential to revolutionize member communication and engagement.

What You Need to Know:

Dive into AI integration by addressing immediate member feedback needs. Use tools like sentiment analysis to provide actionable insights.

Quotables:

Scott Maronic: “We wanted to get our hands on this technology quickly… Member feedback through our digital channels was an opportunity to start getting hands-on really quickly.”

Thomaz DeMoura: “We don’t tell employees that [the technology] is in the background. It’s a bot that helps improve efficiencies.”

Digital Adoption Strategies

At A Glance:

The panel discussion titled “Digital Roadmap: Creating, Deploying, and Measuring Success” delved deep into the strategies, challenges, and insights around the digital transformation journey in credit unions. With the digital realm being a critical component in today’s financial landscape, the panelists emphasized the importance of adopting a proactive approach, understanding members’ needs, and ensuring seamless integrations. The discussion also touched on the significance of UX, the challenge of feature overload in apps, and the pivotal role of trust in the digital experience.

What You Need to Know:

Digital Engagement is Key: Embrace digital transformation and ensure that digital solutions are user-centric and aligned with member needs.

User Experience (UX) Matters: With an increasing number of app features, it’s crucial to ensure a clean, intuitive user experience.

Trust is Essential: Digital offerings should build and maintain members’ trust. Being transparent and prioritizing member interests will differentiate CUs from traditional banks.

Collaboration is Beneficial: Collaborate with fintechs and third-party providers to enhance digital offerings and stay competitive.

Stay Updated with Trends: Regularly evaluate digital solutions, keep an eye on emerging technologies, and be ready to adapt to changing member preferences.

Incentivize Digital Adoption: Consider introducing incentive programs for frontline teams to promote digital product adoption among members.

Personalization is the Future: Personalized digital experiences can lead to deeper member connections and satisfaction.

Quotables:

Lindsay Oparowski: “Just because it [a feature] is there does not mean people understand how to use it… Tell everybody seven times how to use it and why.” and my favorite quote “come up with something that’s going to make them smile and really feel like they have a connection with us”

Alex Michaud: “Online banking, we’ve got about 65% adoption, mobile is about 45%. The key indicator for me of success is how these numbers will change years down the road.”

Damon Sipe: “Are your digital features first or second class citizens across your organization all the way through”? And “getting really clear for the organization. Why? Why are you looking for digital engagement?”

Jim Phillips: “Whenever we put anything out that’s new in terms of digital… we always think we should see a decrease in branch traffic or call center traffic and we never do.”

Navigating the AI Frontier: Transforming Credit Unions & Empowering Members

At A Glance:

This panel emphasized the profound implications of AI’s ascent for credit unions. The focus was on how AI can empower credit unions to offer enhanced services.

What You Need to Know:

Start small, but start now. The AI landscape is evolving rapidly, and early adoption can provide a significant edge.

Quotables:

John Best: “Table stakes have never moved with such speed, and if you’re not using AI, are you left behind?”

Joey Rudisill: “All it takes is a little ingenuity and determination… It’ll build upon itself and you’ll find more and more use cases.” and “I think we’re going to see a tidal wave of innovation on our production,” and “It unlocks new superpowers. And ultimately, if you’re serving members better, this will be better for everyone.”

Kathy Sianis: “If you’re not looking at AI in 2024, you’re gonna wish that you would have because it’s going to be moving so quickly, and then it’s just going to change everything!”

Saroop Bharwan: “By 2030 I think all of us are going to have a chief of staff in our pockets available to us to book our flights, manager calendars, answer our emails, I think we’re gonna wonder why we ever did that manually”

Conclusion

The CUNA OME Conference 2023 wasn’t just an event, it was an experience, a platform where ideas met innovation, and professionals connected over shared visions for the future of credit unions. At AEQ, we’re eager to integrate these insights into our strategies and operations.

Are you a CU leader keen on harnessing the power of AI and digital innovation? Connect with the AEQ team for a personalized consultation, and let’s explore collaborative opportunities to elevate your credit union’s digital journey. Together, let’s chart a promising future for your credit union!

Stay tuned for more updates and reflections from Team AEQ, where we believe an AI-driven future is a brighter future for credit unions.

Are you a CU leader keen on harnessing the power of AI and digital innovation? Connect with the AEQ team for a personalized consultation, and let’s explore collaborative opportunities to elevate your credit union’s digital journey.

Subscribe to AEQ’s monthly newsletter to receive expert analyses, exclusive event invites, and the latest industry trends straight to your inbox. Together, let’s chart a promising future for credit unions!

Adrian Moise

Adrian is the Founder and CEO of Aequilibrium, one of Top 5 Digital Agencies in Vancouver, Canada, winner of several VancouverUX awards for digital product design, voted twice among the Top 5 Best Employers. Our vision is to enrich people’s lives by crafting remarkable digital experiences. We provide end-to-end technology solutions (Strategy, Design, and Development). We build web, mobile and XR solutions for progressive organizations who want to be more resilient, differentiate, and grow.