The Digital Banking Transition

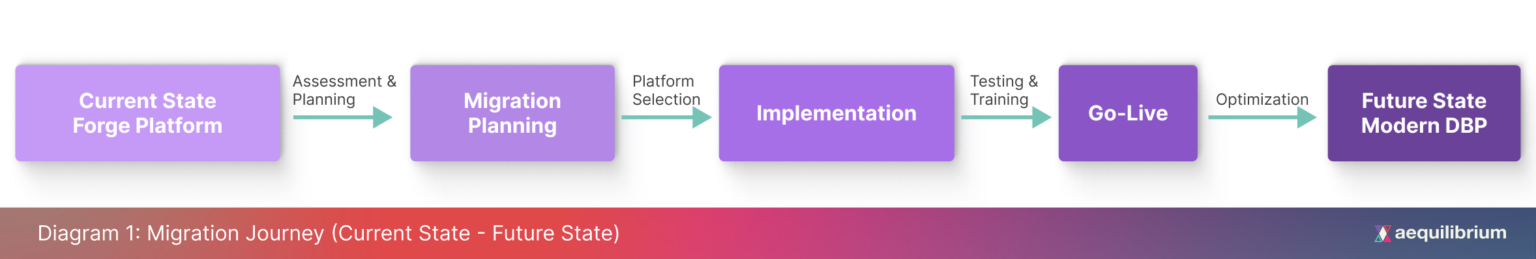

With Forge’s end-of-life announced, credit unions find themselves at a critical juncture. This article outlines key considerations, essential migration steps, and common challenges credit unions should anticipate along the way.

Forge has been a key digital banking platform for many Canadian credit unions, but as Central 1 phases it out, credit unions must take decisive action to transition to modern solutions. This transition is more than just a platform swap—it’s an opportunity to enhance digital capabilities, improve operational efficiency, and future-proof banking services for members.

Some credit unions have already started planning, while others are still trying to figure out their next move. Some are well into their migration planning, while others are grappling with the complexities of selecting a new digital banking provider and ensuring seamless integration with core banking systems. The process requires meticulous planning and execution to avoid disruptions, mitigate risks, and ensure a smooth transition.

The right expertise makes all the difference—credit unions need to work with experts who understand both vendor selection, integration challenges and regulatory considerations.

Why Migrate from Forge?

Forge is being phased out—but instead of seeing this as a challenge, credit unions should see it as an opportunity to upgrade, innovate, and future-proof their digital banking services. Beyond the mandatory transition, moving to modern platforms offers significant advantages:

- Enhanced Member Experience: Modern UX design patterns, personalization capabilities, and omnichannel delivery.

- Technical Advantages: Opportunity to shift to cloud-native architecture, microservices-based design, and API-first approach.

- Business Agility: Faster time-to-market for new features and simplified third-party integrations.

- Improved Analytics: Advanced reporting capabilities and real-time insights into member behavior.

- Future-Proofing: Regular platform updates and continuous innovation from dedicated digital banking providers.

Critical Success Factors in Digital Banking Migration

A smooth migration doesn’t happen by accident. It requires careful planning, the right technology, and the right team to take a proactive approach to security and compliance. Ensuring a proper transition requires expert guidance to navigate each step of the migration process, from initial planning to post-deployment support, addressing potential challenges proactively to reduce costly disruptions.

1. Strategic Planning and Stakeholder Alignment

Before embarking on migration, it is crucial to define success metrics, align stakeholders, and assess current infrastructure and integrations. Identifying gaps between Forge and the new platform helps in setting clear objectives.

2. Data Migration and Integrity

Ensuring data accuracy is one of the biggest challenges in migration. Credit unions should focus on:

- Conducting a thorough data audit before migration.

- Defining transformation rules to align with the new platform’s schema.

- Implementing validation checks to ensure data consistency.

3. Infrastructure and Security

Choosing between cloud and on-premises deployment, setting up core banking integrations, and establishing strong security protocols are fundamental for a successful migration. Security measures like encryption, access controls, and multi-factor authentication should be prioritized. Credit unions must also ensure compliance with regulatory requirements to avoid any post-migration legal or operational risks.

4. Testing and User Readiness

Testing is an essential phase that includes system integration testing (SIT) and user acceptance testing (UAT). Your team needs to be ready. Training and clear documentation can make all the difference in adoption.. Authentication migration is a key factor, as transitioning member credentials and security settings must be seamless to avoid disruptions.

5. Post-Migration Support and Optimization

After go-live, monitoring system performance and providing ongoing support are crucial for a seamless transition. Having a dedicated hypercare team helps in quickly addressing any operational challenges. Maintaining business continuity during migration requires robust fallback plans and clear member communication strategies.

Common Gotchas to Avoid

Even with a structured approach, some common pitfalls can derail a migration. Engaging an experienced, technology-agnostic implementation partner like Aequilibrium can help mitigate risks such as incomplete integration planning, underestimating data migration complexities, and overlooking regulatory compliance nuances.

Avoiding these mistakes ensures a smoother transition and minimizes disruptions.

- Inadequate Data Cleanup – Poor data quality can lead to poor migrations. For example, a credit union that migrated without cleaning up inactive accounts and duplicate records faced significant reconciliation issues during and post-migration.

- Integration Dependencies – Understanding the sequence of integration and dependencies are crucial to minimize disruption. Don’t assume! Assuming the new digital banking platform would integrate seamlessly with your current payment processor, only to discover the incompatibility in post-migration that additional API development was required, substantially delays migration for weeks. Mapping out dependencies beforehand prevents these headaches.

- Performance Assumptions – New platforms may have different performance characteristics requiring infrastructure adjustments.

- Incomplete Member Journey Mapping – Failing to identify all current user workflows and features can result in gaps in functionality.

- Historical Data Decisions – Determining how much historical data to migrate versus archive is critical to successful migration.

Why You Need the Right Implementation Partner

A technology-agnostic partner offers unbiased expertise, ensuring a migration strategy aligned with the credit union’s unique needs. Their role includes:

- Objective Guidance: Ensuring credit unions receive recommendations based on their specific needs rather than vendor affiliations.

- Vendor-Neutral Recommendations: Avoiding vendor lock-in by providing flexible, adaptable solutions.

- Seamless Integration Expertise: Aligning core banking, third-party services, and regulatory requirements efficiently.

- Accelerated Implementation: Reducing downtime and optimizing migration processes through proven methodologies.

- Risk Mitigation: Providing expertise in troubleshooting, issue resolution, and post-migration stabilization.

With the right implementation partner, migration doesn’t have to be overwhelming. They help simplify the process, reduce risks, and ensure a smooth transition to your new platform. This ensures a smooth transition while maximizing the benefits of their new digital banking platform and minimizing disruptions.

Risk Mitigation Strategies

To ensure a smooth migration, credit unions should focus on key risk mitigation strategies:

- Business Continuity Planning: Developing contingency plans and backup systems helps maintain service availability during unexpected disruptions.

- Member Communication: Keeping members informed through proactive updates and clear transition timelines reduces confusion and enhances trust.

- Regulatory Compliance: Regular audits and adherence to industry regulations ensure data security and legal compliance throughout the migration process.

- Concurrent Operations Management: Running parallel systems where needed minimizes downtime and mitigates risks during the transition.

These proactive measures help credit unions navigate migration challenges more effectively while ensuring a seamless experience for members. Navigating a digital banking migration is complex, and working with an experienced, unbiased implementation partner can significantly ease the transition.

Moving Forward: Taking the Right Steps Toward Digital Transformation

Migrating from Forge to a new digital banking platform is a significant undertaking, but with careful planning and execution, credit unions can have a successful transition for both their team and their members. By focusing on strategic alignment, data integrity, infrastructure readiness, and robust testing, they can enhance their digital banking capabilities while mitigating risks.

For credit unions preparing for migration, engaging with experienced partners can provide the expertise and support needed to navigate the journey successfully.

Want to ensure a smooth transition? Our team has guided multiple credit unions through successful migrations—let’s talk about how we can help you do the same.

Baris Tuncertan

Head of Technology

Reach out to Baris directly or contact our team for more information