For over a decade, Forge (formerly MemberDirect) has been the digital backbone for many Canadian credit unions (CUs). Built by Central 1, Forge represents a remarkable achievement—an ecosystem integrating public websites, digital banking platforms, and seamless member experiences. It provided not just technology but a shared infrastructure that enabled smaller credit unions to compete with larger players, creating economies of scale that have benefited the entire CU system. However, with Forge being sunset, Canadian credit unions face a crossroads that could redefine their digital strategies and, by extension, their futures.

Having partnered with Central 1 for the past 10 years, AEQ has been at the forefront of Forge’s evolution. From helping Central 1 design the first mobile-responsive MemberDirect platform to building multiple iterations of Forge atop Backbase, we’ve seen firsthand how this platform has empowered credit unions of all sizes. We’ve also helped deploy and customize Forge for dozens of CUs, tailoring everything from public websites to mobile apps, and even adding unique features like multi-tenancy—a capability rarely found in off-the-shelf Digital Banking Platforms (DBPs).

Now, as credit unions explore their next steps, AEQ acts as a trusted advisor, helping them navigate the complex landscape of DBP options, implementation challenges, and long-term strategic decisions.

The Challenges Ahead: From Turnkey to Curated Ecosystems

Forge has been more than just a platform; it’s been a comprehensive, all-inclusive solution. It delivered web and mobile banking, public websites, marketing tools, and calculators in a unified package. For credit unions, it was an all-in-one platform that made managing digital banking simple and efficient.—. However, with Forge’s retirement, credit unions now need to piece together separate tools and systems to match the seamless experience Forge offered.

This is no small challenge. Many DBPs, while innovative, do not offer the breadth of functionality that Forge provides. For instance, public website capabilities are often missing or require separate integrations. Operating these new, unproven combinations demands more resources—money, skills, and manpower—than many credit unions currently have. Smaller credit unions, in particular, face increased pressure to merge or risk becoming “undesirable” in a competitive landscape dominated by larger players and consolidations.

Leadership Decisions: A 3-to-5-Year Horizon

The first and most critical decision credit unions face is leadership: What DBP best supports their digital strategy and business goals for the next 3-5 years? This is not just about technology; it’s about vision. A DBP must align with the credit union’s goals for member engagement, operational efficiency, and long-term growth.

For example, when Central 1 launched Forge, champions like FirstWest, Alterna, and FirstOntario led the way. However, the landscape has shifted: Alterna transitioned to eBankIT two years ago, and FirstWest and FirstOntario have recently announced partnerships with VeriPark and Temenos, respectively. These shifts underscore the importance of a strategic approach to DBP selection, which considers features and the alignment of technology with the credit union’s unique needs and aspirations.

The New DBP Landscape: Opportunities and Risks

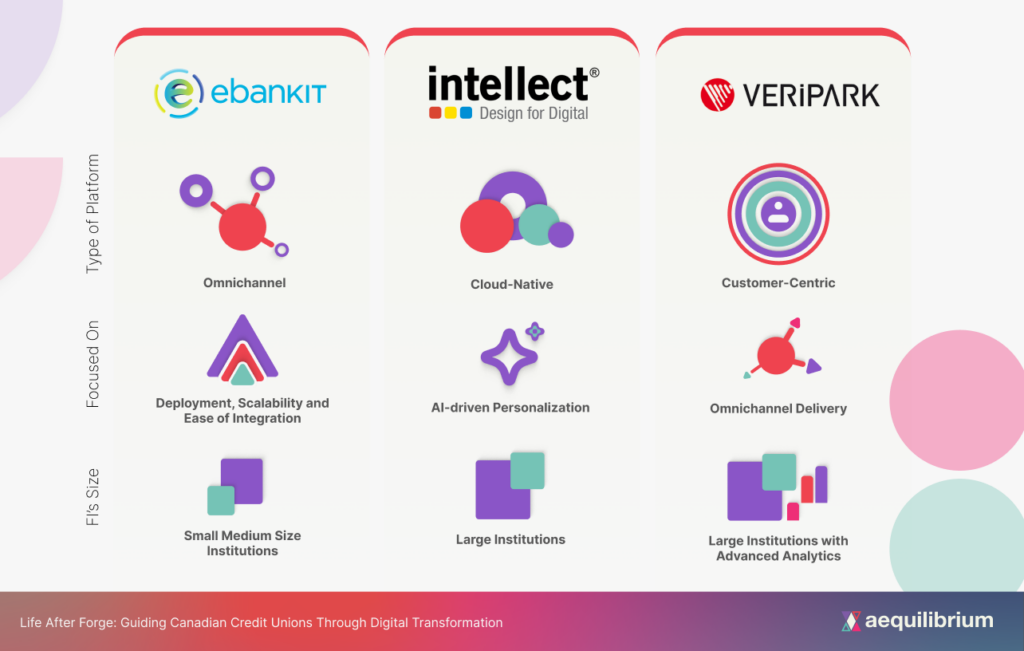

The DBP market in Canada is now more competitive than ever. Players like eBankIT, VeriPark, and Intellect Design are vying for market share, each offering a unique value proposition. But the stakes are high, particularly for larger credit unions. Landing a partnership with one of the remaining large CUs could define a DBP’s reputation in Canada for years.

Smaller credit unions face a different set of challenges. They lack the bargaining power of their larger counterparts and often struggle to allocate resources for complex migrations. This is where group decisions, like the coalition announced by FirstWest Credit Union, Prospera Credit Union, DUCA Credit Union, and Coastal Community Credit Union, can play a pivotal role. These coalitions can negotiate better deals and achieve economies of scale by pooling resources and aligning on shared goals. But what brings these groups together? Shared vision, similar core systems, or a collective understanding of their members’ needs? These questions will shape the future of digital banking for smaller CUs.

Central 1: A Legacy of Collaboration

Central 1 remains a vital stakeholder in this ecosystem. Their efforts to create Forge were nothing short of transformative, and their commitment to enabling smaller credit unions to leverage a competitive platform at affordable rates cannot be overstated. Forge’s cost model, which distributed expenses based on asset size and member base, allowed smaller credit unions to punch above their weight.

AEQ’s partnership with Central 1 has spanned over a decade, with projects like designing the platform and usability testing a mobile point-of-sale system, integrating mobile wallets with Interac and Everlink, and pioneering tokenization and biometrics for large credit unions. Our unique position in understanding the ins and outs of the Forge platform supports Central 1 and its credit union partners in navigating this next phase of digital transformation.

Implications of Consolidation in Canada

The Canadian credit union landscape is changing rapidly. Consolidation is accelerating, with the total number of credit unions declining significantly over the past two decades. This trend mirrors what we’ve seen in the U.S., where the number of credit unions has dropped by more than 50% in the same period. In Canada, recent mergers like the acquisition of Celero by CGI highlight the growing influence of large technology providers in the CU space.

For smaller credit unions, this consolidation trend poses existential challenges. Without the resources to invest in modern DBPs or the ability to negotiate favorable terms, they risk being left behind. The long tail of smaller CUs will need to innovate, collaborate, or merge to survive. AEQ helps these credit unions differentiate signal from noise, identify the right partners, and build coherent, complete digital solutions that support their unique needs.

Building for the Future: The AEQ Advantage

We guide Canadian credit unions through this period of transformation. Our expertise spans technology, strategy, experience design, and delivery excellence. Here’s how:

- Unmatched Forge Expertise: With a decade of experience building, deploying, and customizing Forge, AEQ understands the platform inside and out. We’ve worked on dozens of projects with Central 1, from support for serving multiple credit unions with tailored features on a single platform. to public website integrations.

- Experience Design: AEQ excels in creating member-centric experiences that differentiate credit unions in a crowded market. We balance innovation with practicality, ensuring every design decision contributes to improved member satisfaction and engagement.

- Delivery Excellence: Many DBP projects take longer and cost more than planned, often delivering fewer features than promised. AEQ’s agile delivery framework ensures projects stay on track, leveraging metrics like code quality, velocity, and test coverage to maximize ROI.

- Strategic Advisory: AEQ provides expert guidance to help credit unions choose the right technology for their future.

Leading with Vision

The transition from Forge is not just a technological challenge; it’s a strategic opportunity. Credit unions approaching this moment with vision and purpose can position themselves for long-term success. The first step is choosing the right partner—not just a DBP provider — but a trusted advisor who understands the unique dynamics of the Canadian CU ecosystem.

At AEQ, we’re committed to being that partner. Whether it’s navigating the complexities of DBP selection, curating integrated digital solutions, or ensuring flawless delivery, we bring the expertise and dedication credit unions need to thrive in this new era.

Schedule a complimentary 30-minute consultation with our team to discuss your digital transformation journey.