In an era where smartphones have become an extension of ourselves, users are looking to optimize every part of their life. This remarkable shift to digitization has left businesses struggling to keep up. One industry, however, has shown exceptional adaptation to the ever-changing needs of their consumer: the banking and credit union industry.

Research suggests that younger generations prefer mobile banking apps over traditional in-person banking, when it comes to making decisions about their finances. This has forced thousands of global banking companies to catch up with the times. Based on our research, we have compiled 3 features that every mobile banking app needs in order to stay ahead of the game, and to keep their consumers happy.

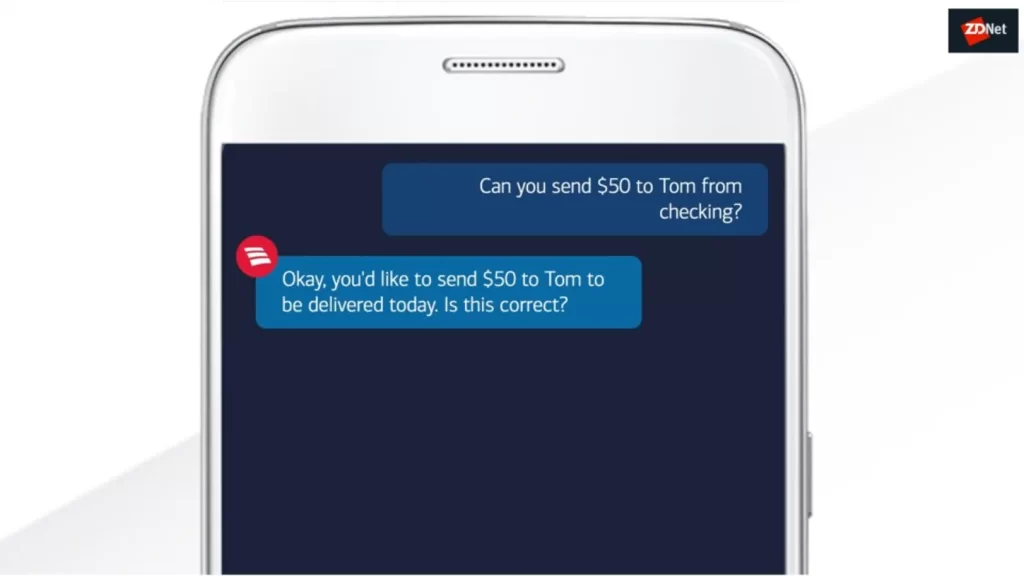

1. A Personalized Digital Assistant

An in-app digital assistant might be exactly what your mobile banking app needs to ensure your consumers are making informed financial decisions. Bank of America’s mobile app assistant, Erica, is a personalized digital assistant that can execute a variety of tasks based on your requests. Erica is able to help with cheque deposits, notify users when a duplicate charge is recorded, and even provide weekly updates on monthly spending.

This artificial-intelligence powered (AI) financial assistant is the first of its digital kind. Erica is able to record and store individual data (securely), and connect users with a human agent, who can pick up right where the conversation left off. Furthermore, by using natural language processing (NLP), Erica can predict the reason what the consumer is asking for, and return the appropriate resources quickly.

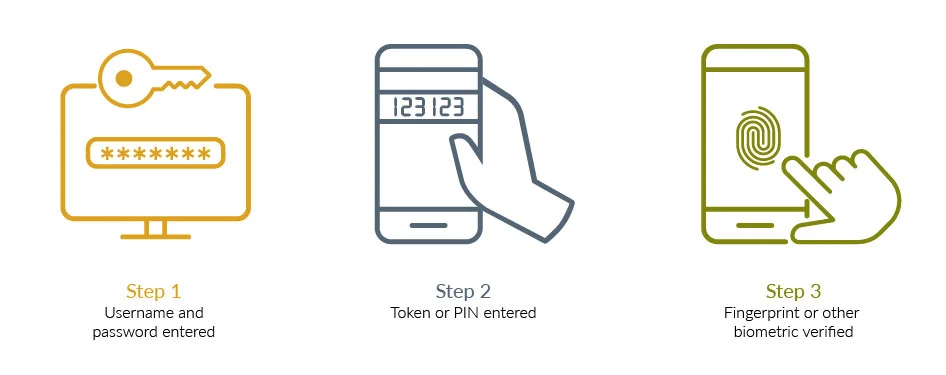

2. Multiple Layers of Security

The rise in popularity of mobile apps comes with a parallel rise of cybercrimes, such as fraud and security breaches. Given the lack of in-person authentication that comes from traditional banking methods, users must be wary of both phishing (fraudulent communication purporting to be from the bank) and social engineering scams (psychological manipulation to retrieve personal information).

To combat this, mobile banking apps should include the following features:

- Multi-factor authentication (MFA)

- Real-time notifications about suspicious activity in a user’s account

- Geographical and online activity monitoring

- Digital fingerprint and behavioral biometrics

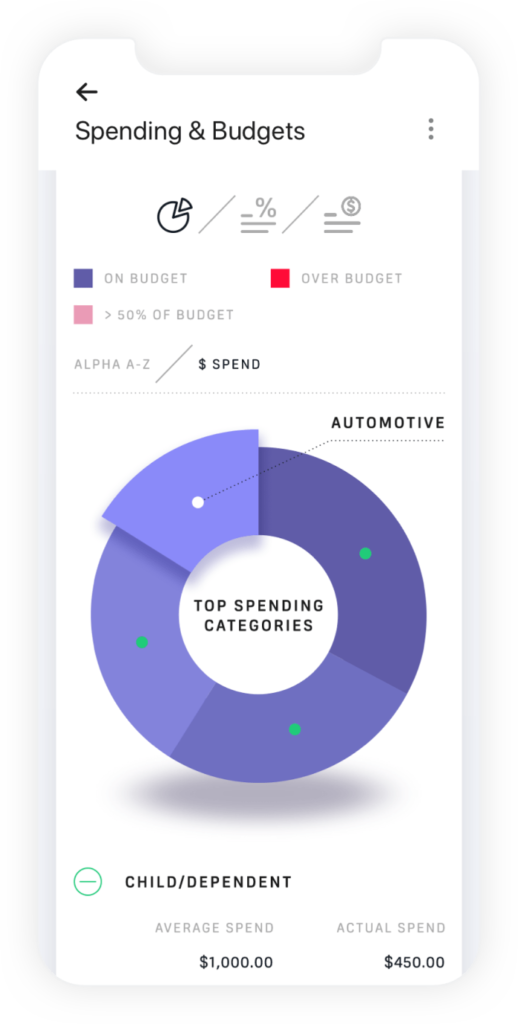

3. A simple and easy-to-use digital interface

A clean and easy-to-understand user interface (UI) allows consumers to make quick and simple decisions about their finances on a daily basis. Research shows that a frustrating mobile banking experience can actually cause a consumer to switch financial institutions entirely, which emphasizes the importance of human-centered design.

Here are a few features of seamless UI design that will elevate your mobile banking experience:

- Effortless authorization (fingerprints and biometrics)

- Clear and immediate displays of key data, such as your chequing and saving balances, and transaction history

- Navigational freedom (‘Undo’ or ‘Cancel’ buttons that increase user confidence)

Blending the human and digital experience is a core value for our team at Aequilibrium. If you would like to read more about how our team helps credit unions elevate the member experience, visit us at www.aequilibrium.com