By Baris Tuncertan, Head of Technology at Aequilibrium

Setting the Stage

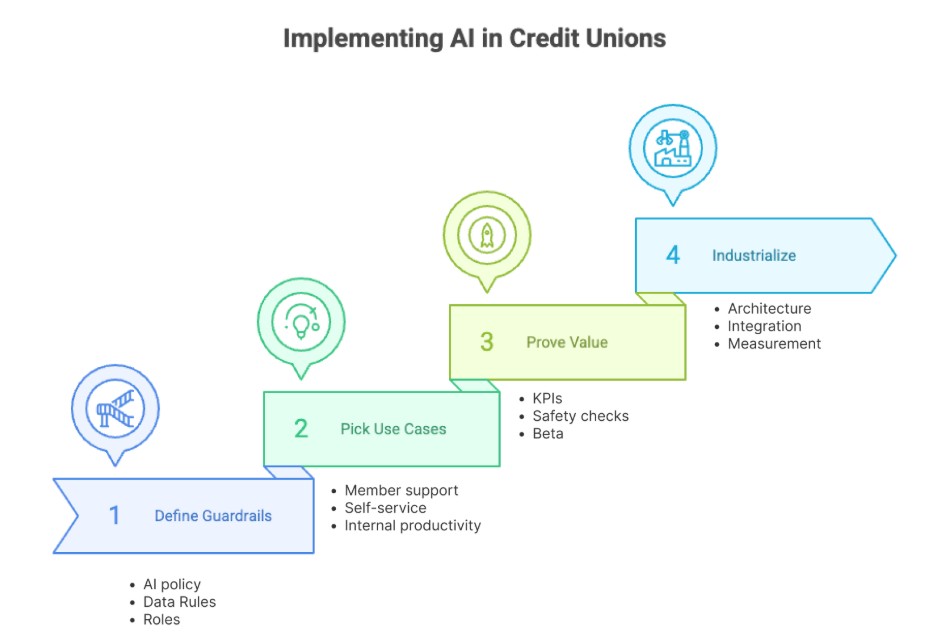

Credit unions don’t need rocket science to start with AI, they need a safe, member-first path from policy to prototype. At Aequilibrium, we’ve helped credit unions modernize digital experiences, migrate platforms, and operationalize change with speed and clarity. This playbook style blog post lays out four practical steps any credit union can take to craft an AI strategy that balances trust, compliance, and tangible value for members.

- Step 1: Define the guardrails — policy, risk, and governance

- Step 2: Pick high‑leverage, low‑risk use cases

- Step 3: Prove value fast with a 6–8 week prototype

- Step 4: Industrialize responsibly — scale, integrate, and measure

Our approach is shaped by years of delivery for banks and credit unions across North America and rooted in member-centric design, agile execution, and platform agnostic approach.

Why AI, why now and why a “policy-to-prototype” approach?

Across the credit union community, leaders are moving beyond AI buzzwords to practical blueprints focused on trust, data discipline, and member outcomes. The conversations at industry events consistently come back to the same themes:

- Digital trust;

- Speed to value;

- Journey mapping;

- The shift from “parity” to “future‑proofing” your stack.

We’ve documented these shifts in our recent thought leadership on migration and delivery excellence, including prioritizing edge experiences (web/CRM) as much as the digital banking platform and focusing on execution playbooks your teams can sustain long-term.

See recent perspectives on momentum in the CU community and delivery best practices in our blog hub:

Step 1: Define the guardrails - policy, risk, & governance

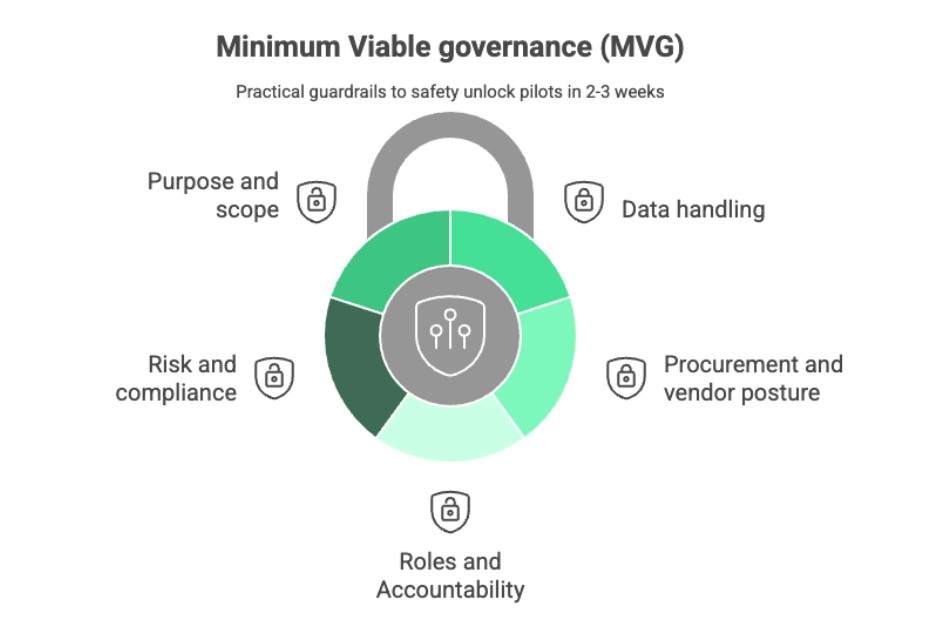

Before you pilot a single model, align on a simple, usable AI policy that your teams can actually follow. Treat this like a “MVG (Minimum Viable Governance)” layer that you can expand over time.

What to establish in 2–3 weeks:

- Purpose and scope

- Approved AI use cases (internal productivity vs. member-facing)

- Explicit non-uses (e.g., underwriting decisions without human-in-the-loop; sensitive PII processing without encryption)

- Data handling rules

- What data can/can’t be sent to third-party LLMs?

- What are the anonymization, masking, tokenization standards?

- How to handle retention, logging, and auditability?

- Risk and compliance framework

- Human oversight and approval points

- Model risk management basics (versioning, bias checks, exception handling)

- Alignment to applicable guidance (privacy, consumer protection, accessibility)

- Roles and accountability

- Executive sponsor (e.g., COO/CIO)

- AI Working Group (Tech + Risk + UX + Operations)

- Product owner and data steward for each pilot

- Procurement and vendor posture

- Security requirements, SLAs, and exit provisions

- Data residency and model hosting options (private, virtual private, or public endpoints)

TIP: Keep the first policy short and practical. It should unblock pilots while building confidence with Risk and Compliance. You can extend it once you learn from real usage.

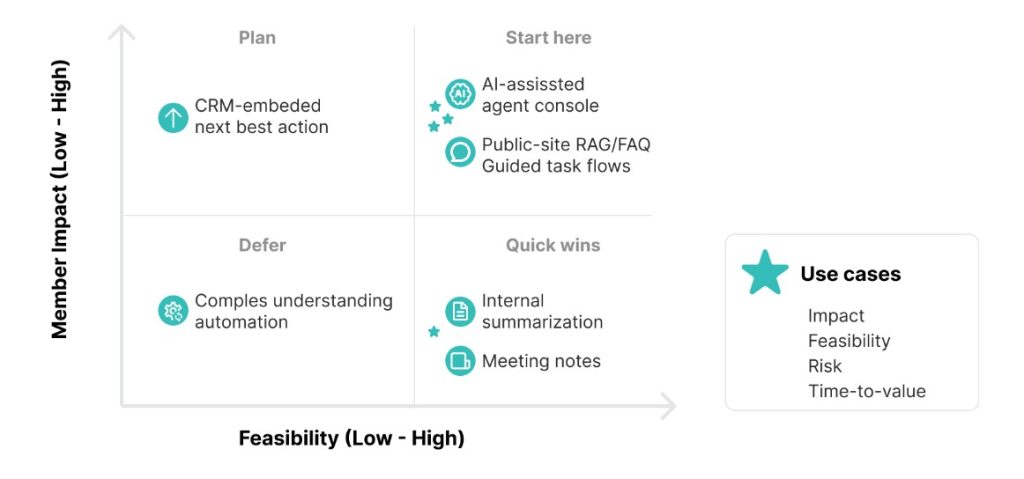

Step 2: Pick high‑leverage, low‑risk use cases

Start where value is clear and risk is manageable. In our work with credit unions, three categories consistently stand out:

1. Member Support

- AI-assisted agent console: summarize cases, suggest next best actions, auto-draft replies

- Knowledge retrieval: surface relevant policy, product, and rate info to staff in seconds

- Why now: Tangible cost-to-serve reduction and improved CSAT, without exposing PII externally if you use retrieval over governed content

2. Digital self-service uplift

- Smarter search and FAQ with retrieval-augmented generation (RAG) over your public site and knowledge base

- Guided task flows: “Help me dispute a charge” or “How do I set up a CRA direct deposit?”

- Why now: Improves success on high-traffic tasks and reduces call volumes; minimal risk if scoped to public content

3. Internal productivity

- Drafting and summarization for operations, lending ops, or marketing compliance reviews

- Automated meeting notes, action item extraction for servicing and product teams

- Why now: Quick wins that free staff for higher-value member work

Prioritize use cases on four axes:

- Member impact: Does this reduce friction or increase trust?

- Feasibility: Do you have the content, systems, and access needed?

- Risk: Can you keep data inside safe boundaries with today’s controls?

- Time-to-value: Can you deliver a measurable result in 6–8 weeks?

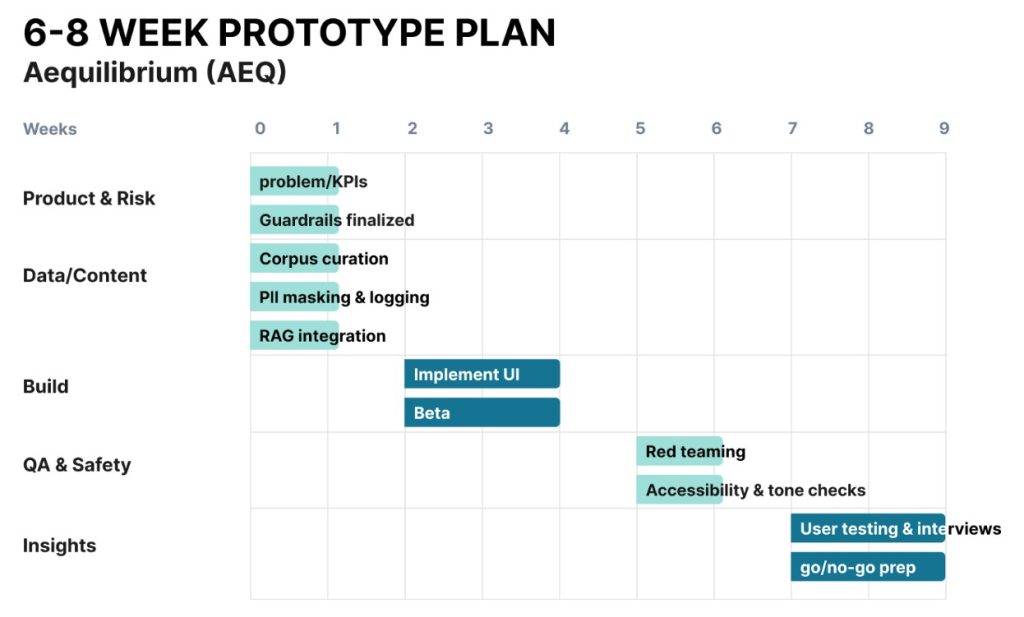

Step 3: Prove value fast with a 6–8 week prototype

Treat your first AI initiative like a product sprint with a clear definition of done.

Week 0–1: Set the foundation

- Finalize problem statement, KPIs, and guardrails with Risk and Compliance

- Curate a safe content corpus (public site, sanitized KB, or redacted policy docs)

- Choose the stack: start with retrieval over your content, then bring in generation

- RAG pattern with vector search

- Contain PII via masking; log prompts/responses

Week 2–4: Build and iterate with users

- Implement a thin UI: staff console or web widget

- Connect to your governed content sources and CRM/website search if needed

- Beta with 5–10 frontline staff or a small member cohort

- Measure everything: queries, response helpfulness, number of handoffs to humans

Week 5–6: Safety, quality, and compliance checks

- Red-team prompts; test adversarial inputs

- Add guardrails: refusals, tone, escalation flows

- Embed accessibility and inclusive language checks

Week 7–8: Prove the business case

- Report against KPIs: deflection rate, handle time, CSAT/NPS proxy, staff productivity

- Document errors and boundary conditions

- Produce your “go/no-go/extend” decision, with a clear next step

Definition of done for the prototype:

- A measurable lift on at least one KPI

- Documented safety controls and escalation paths

- A backlog of enhancements and an ops “run book”

- Alignment from Tech, Risk, and Operations to move to pilot

Step 4: Industrialize responsibly - scale, integrate, and measure

Once the prototype proves value, scale deliberately.

- Architecture and platform choices

- Decide on your deployment pattern: hosted model API with strong contractual controls vs. private/virtual private deployment

- Standardize on a retrieval layer over your approved content sources

- Introduce model observability: monitor drift, response quality, and anomaly detection

- Integration into your digital stack

- Website and CRM: prioritize the “edge” experiences where trust is earned daily

- Digital banking platform: integrate through supported frameworks and partner ecosystems

- Events and analytics: capture end-to-end interaction telemetry for continuous improvement

- Operating model and controls

- AI Advisory cadence: safety reviews for new intents/content

- Content governance: freshness SLAs, ownership, and depreciation rules

- Incident playbooks: automatic fallbacks and human takeover paths

- Measurement and transparency

- Publish a member-facing AI use statement: what AI does (and doesn’t) do at your CU

- Track both efficiency and trust metrics: deflection, productivity, first-contact resolution—and complaint rates, escalation rates, accessibility

- Run quarterly “bias and fairness” reviews on representative cohorts

What good looks like in 6 months

- Members can self-serve complex tasks more confidently via a guided AI experience on your site, with clear handoffs to humans when needed.

- Contact center agents resolve cases faster with AI-augmented context and compliant drafting assistance.

- Your teams have a simple AI policy they actually use, a working retrieval stack over governed content, and an operating rhythm with Risk.

- You have a documented ROI story: lower cost-to-serve, higher satisfaction, and faster delivery cycles—without compromising privacy, accessibility, or fairness.

Common pitfalls to avoid

- Skipping governance and retrofitting controls later. Start small, but start safe.

- Over-indexing on “model shopping” instead of content quality and retrieval.

- Treating AI like a one-off tool instead of a supported product with owners, SLAs, and a roadmap.

- Ignoring edge experiences (website, CRM). These are where trust is won daily; align improvements there with your core platform roadmap.

How Aequilibrium can help

We partner with credit unions to move from buzzwords to business outcomes, balancing speed with safety.

- Strategy and governance: Lightweight AI policy, risk controls, and a clear RACI

- Member-first design: Journey mapping to target the highest-impact moments

- Rapid prototyping: 6–8 week sprints with measurable outcomes

- Integration and delivery: Website/CRM uplift, digital banking platform integration, and managed services for ongoing improvement

Explore our latest articles and perspectives on credit union modernization and delivery excellence at the Aequilibrium Blog and our Banking & Credit Union and FinTech pages.