By Isabela Moise, Product Manager at Aequilibrium

In Brief: Member-First, Data Informed with Journey-Mapping and AI

- Journey-Mapping First: CUs must start with the member’s perspective by mapping real pain points before applying AI, so techn solves what truly matters .

- From Friction to Trust: Pain points like redundant forms, false rejections, and weak onboarding can be transformed into trust-building moments with intentional AI and human-in-the-loop design

- Empowering Staff with VR + AI: Immersive training scenarios prepare employees to practice empathy, build confidence, and deliver consistent member-first service at scale

- Innovation with Empathy: : The future belongs to credit unions that balance digital innovation with human connection AKA using technology as an enabler, not a replacement

The hum of conversation outside our session room at the America’s Credit Union Operations & Member Experience Conference told me everything:

CU leaders here weren’t just curious about technology, they were wrestling with how to make it meaningful for their members

Standing at the door with Kim Beluzo from LinkLive, greeting and drawing people in, I felt the essence of what we’d come to share: transformation starts not with tools, but with human connection.

Inside, I joined Adrian Moise, CEO of Aequilibrium, to present “From Insight to Impact: Using Journey Mapping and AI to Drive Member-Centric Innovation.”

As a Product Manager of our Training Academy, my work centers on how AI and Virtual Reality (VR) can empower staff through immersive learning to help them internalize the member-first ethos, and elevate their experience-offering to achieve the CU’s vision. But this conversation was about something even bigger: how CUs can transform friction into trust, and trust into loyalty.

Primed for the Conversation

By the time we took the stage, the room was already tuned in.

On Sunday, Futurist Heather McGowan had challenged us to see AI as an augmenter, not a replacement, urging CUs to keep people in the loop and rethink our approach to collaborating with AI.

That morning, Charlie Peterson of Allied Solutions drove home the urgency of reaching the next generation, reminding us that acquiring and retaining younger members is a race CUs cannot afford to lose.

Walking the Member Journey

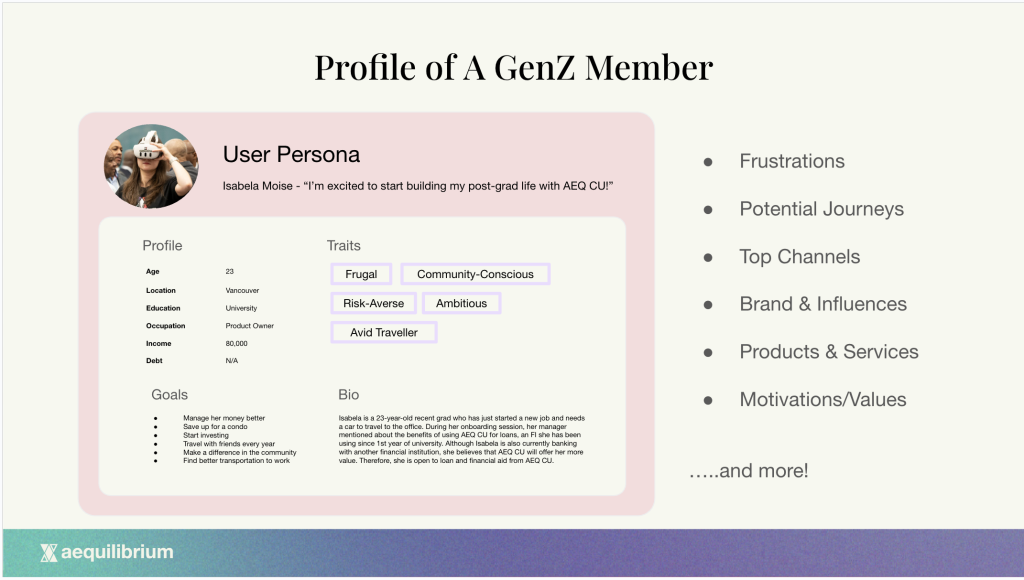

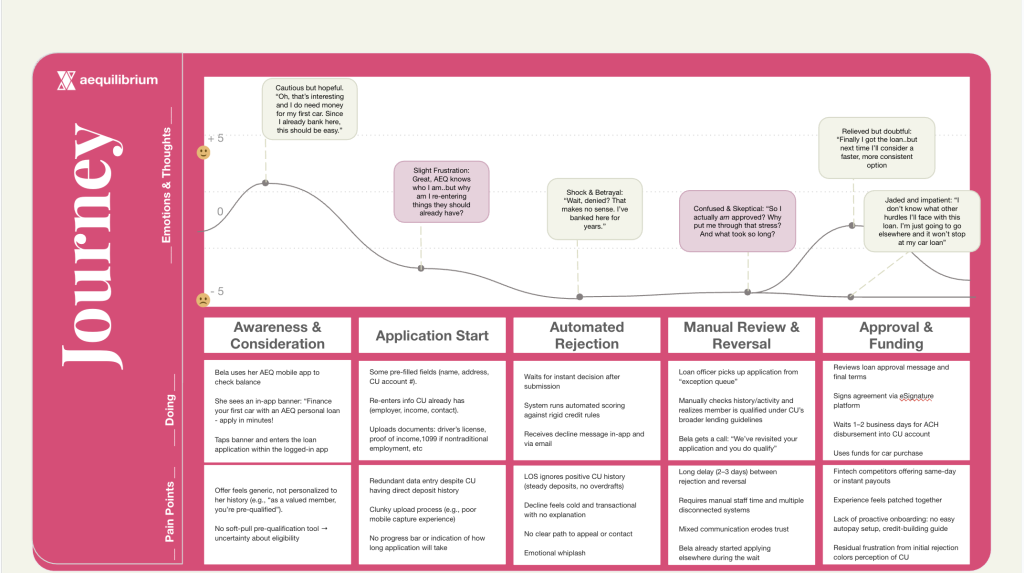

We began with a simple story based on my own experience: a Gen Z graduate opening her CU app, excited to see a car loan offer. But that excitement quickly soured—redundant forms, delayed decisions, false rejections, and onboarding that inspired little confidence.

The journey map told the story visually: emotional highs dropping into lows, trust evaporating with each step. As I told the audience:

“Most Gen Z’s would have walked away by this point.”

Turning Friction into Trust

Yet those pain points aren’t dead ends—they’re opportunities.

- A generic offer becomes a personalized invitation, grounded in real data

- Redundant forms become assisted applications with AI-powered autofill

- Opaque rejections turn into transparent decisions, explained in plain language

- Long delays become human-in-the-loop moments, where empathy bridges what algorithms can’t

- Weak onboarding transforms into trust-building engagement, nudging members toward financial confidence

As I put it:

“Approval shouldn’t be the end of the journey. It should be the beginning of loyalty.”

Preparing the People Behind the Promise

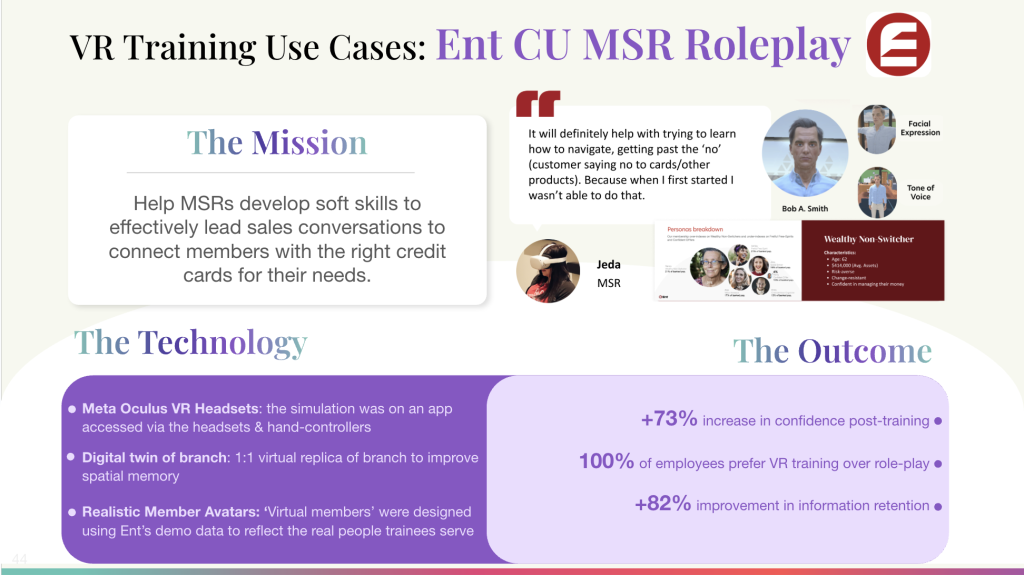

Of course, even the most seamless digital experience is only as strong as the people delivering it. And here, too, CUs face challenges: training that is costly, inconsistent, and too often ill-equipped to build the soft skills members value most.

“You can’t teach empathy from a textbook with a one-week seminar,”

I reminded the room.

That’s why at Aequilibrium we’ve built the VR Training Academy: immersive roleplay scenarios powered by AI, modeled on real member personas. Staff practice vital and difficult conversations and experiences in safe, repeatable environments, gaining not just compliance knowledge but confidence and empathy.

The results from early pilots have been striking: higher retention, measurable skill growth, and staff who feel ready to serve members with more humanity.

As Adrian told the room:

“Watching two hours of tennis doesn’t make me a tennis player. It’s the doing—inside realistic environments—that builds skill.”

The Ethos of OME

Looking back, our session was just one voice in a chorus. Yet with the difference in perspectives throughout the tens of sessions at this conference, the message was the same: CUs that embrace innovation without losing empathy will thrive.

Or, as Adrian closed:

“Start with the member. Use technology as an enabler. And never lose sight of empathy.”

That’s not just the lesson of our session. It’s the call to action for every leader who walks the halls of OME.

Let’s Build Your Next Trust Moment

Whether you’re modernizing lending, rethinking onboarding, or upskilling teams, we can help you move from insight to measurable impact while being safe, pragmatic and fast.

Ready to start turning friction into moments of trust?

Let’s do it together.

Contact us for a 30-minute session to discuss an AI assessment of where this tool would best fit, or about revitalizing training for your team to elevate the member-first experience.

If you’d like access to our full slide deck, also please reach out!