By Adrian Moise, CEO & Founder of Aequilibrium

(Part of AEQ’s Thought Leadership Series on Digital Transformation for Credit Unions)

The Hidden Weight of Good Intentions

When credit unions first adopted digital banking platforms like Backbase, Temenos, Forge, or Lumin, the mission was clear: deliver better member experiences, faster. And many succeeded.

But over time, good intentions led to quiet complexity. Every “small enhancement,” every “quick integration,” every “custom exception” is slowly layered on new code, new dependencies, and new processes.

Eight years later, what was once an out-of-the-box platform has become a labyrinth of customizations.

We call this the digital drag, the invisible weight of technical debt that slows innovation, increases costs, and erodes agility.

Customization: The Silent Tax on Agility

Most credit unions don’t see tech debt as a strategic issue. It lives in backlogs, sprint retros, and integration notes, hidden until a release fails or an upgrade takes six months instead of six weeks.

At Aequilibrium, we’ve seen this pattern repeatedly across credit unions of all sizes. It usually looks like this:

- Fragile upgrades: even minor platform updates trigger days of regression testing.

- Integration sprawl: 40+ systems connected through brittle, one-off APIs.

- Slow delivery cycles: nine-month roadmaps for what should be 90-day outcomes.

- Innovation paralysis: teams are so busy maintaining what exists, they can’t build what’s next.

The irony? The most “innovative” institutions, the ones that customized the most, are now the ones most constrained by their own systems.

Tech Debt Isn’t a Technology Problem. It’s a Leadership One.

Tech debt doesn’t accumulate because developers make bad decisions. It accumulates because organizations reward speed over sustainability and launches over learning.

The result is a widening gap between what leaders think their digital platform can do and what it actually can.

Real digital transformation starts when leadership treats tech debt not as a nuisance, but as an asset-class issue, something that deserves visibility, prioritization, and governance.

A Better Way: Modernization Through Simplification

Eliminating tech debt doesn’t mean rebuilding from scratch. It means simplifying what exists, identifying what’s essential, what’s redundant, and what can be automated.

At AEQ, we guide credit unions through this using a practical, design-led approach that balances experience, architecture, and value.

Here’s how we frame it.

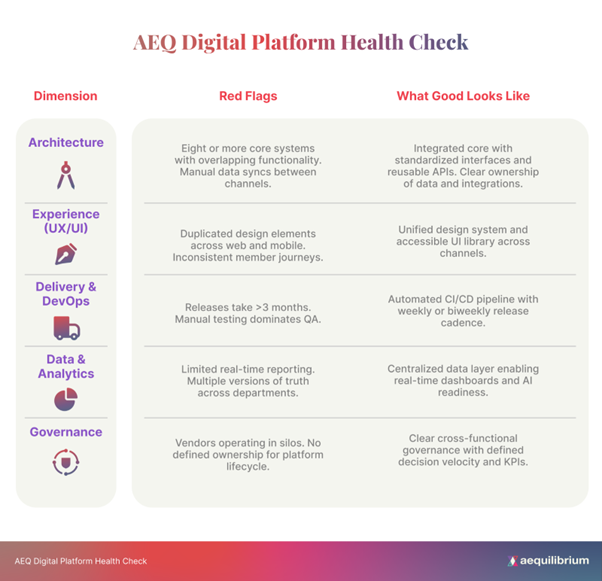

AEQ Digital Platform Health Check

A simple diagnostic to help you assess where your digital platform stands today and where to focus next.

Interpreting Your Digital Health:

Use the indicators above to identify where friction exists in your digital ecosystem.

Healthy: Strong alignment between systems, design, and delivery. Focus on innovation.

Stable: Some inefficiencies exist. Prioritize automation and simplification.

Critical: Structural issues are limiting agility. Modernization is essential.

If your platform shows multiple red flags, you’re likely experiencing digital drag, where your systems dictate your speed, not your strategy.

Three Actions to Start Reducing Digital Drag

- Run a platform audit, not a post-mortem.

Map integrations, redundancies, and delivery cycles. Don’t assign blame, find friction. - Establish a “speed-to-value” KPI.

Track how long it takes to move an idea to production. This metric reveals where the real debt lives. - Invest in simplification as a strategy.

Every system you retire, every process you automate, every manual step you eliminate they all compound into organizational agility.

From Diagnosis to Transformation: AEQ’s 5-Step Proven Process

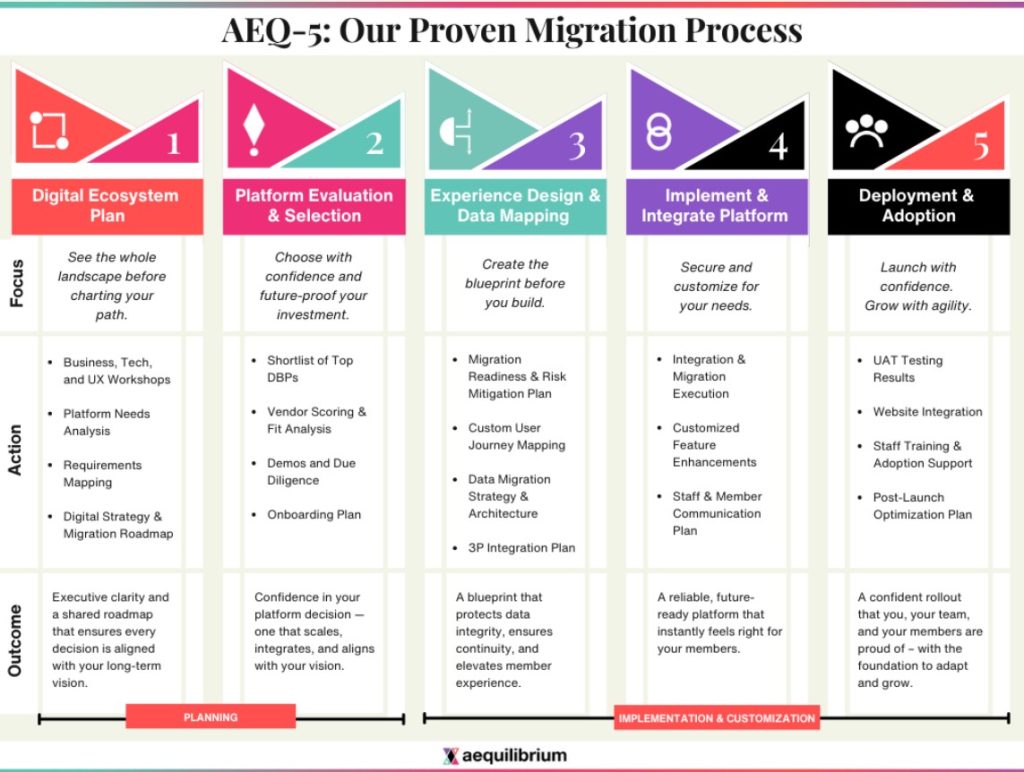

Identifying tech debt is only the first step; the real impact comes from how an organization acts on it. That’s why at AEQ, we use a structured 5-Step Digital Transformation Process to help credit unions move from awareness to execution.

Through Discovery, we uncover the root causes of digital drag; Definition aligns priorities and success metrics; Design reimagines experiences and architecture; Delivery turns strategy into measurable outcomes; and Governance ensures sustainable modernization over time.

This approach bridges the gap between diagnosing tech debt and achieving long-term agility.

Where AEQ Fits In

At AEQ, we’ve spent over a decade helping credit unions modernize without disruption, turning complex systems into agile, future-ready platforms. Our approach combines design thinking, agile engineering, and data-driven modernization to help clients like Ent CU, Wings CU, and WSECU simplify architecture and elevate member experiences.

We treat customization as a matter of design integrity, adding what creates value and removing what creates drag. The challenge isn’t customization itself, but losing structure and intent. By grounding every decision in design, data, and governance, we help credit unions evolve with confidence, building digital platforms that stay fast, flexible, and future-ready.

Next Step: Measure Your Digital Health

Ready to see how your credit union compares? Start your Digital Platform Health Check today and modernize your platform with confidence.

Because transformation isn’t about doing more. It’s about doing what matters, better.